At Gatewood Properties, we have a specific team here to support you in the probate process. We are not only real estate experts but also have the contacts and experience to help you through the challenging, and many times overwhelming, process.

The probate process has many moving parts. It takes time and effort, and we are here every step of the way. We guide you through the real estate, which can include estate sales and clean out of a property. We know what it takes to get maximum value for a property. If you do not have an expert attorney, we have contacts for that aspect of the process. If you just feel lost in all the details, we are here to listen and help you act where needed.

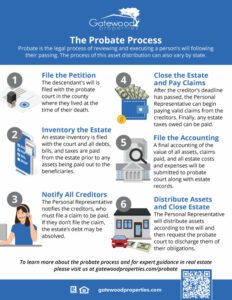

The Probate Process

Probate is the legal process of reviewing and executing a person’s will following their passing. The process of this asset distribution can also vary by state.

- File the Petition – The descendant’s will is filed with the probate court in the county where they lived at the time of their death.

- Inventory the Estate – An estate inventory is filed with the court and all debts, bills, and taxes are paid from the estate prior to any assets being paid out to the beneficiaries.

- Notify All Creditors – The Personal Representative notifies the creditors, who must file a claim to be paid. If they don’t file the claim, the estate’s debt may be absolved.

- Close the Estate and Pay Claims – After the creditor’s deadline has passed, the Personal Representative can begin paying valid claims from the creditors. Finally, any estate taxes owed can be paid.

- File the Accounting – A final accounting of the value of all assets, claims paid, and all estate costs and expenses will be submitted to probate court along with estate records.

- Distribute Assets and Close Estate – The Personal Representative will distribute assets according to the will and then request the probate court to discharge them of their obligations.

Please feel free to download the Probate Process infographic below and don’t hesitate to contact us if you have any questions about the probate process.

FAQ

- Why is probate required?

Probate is set up to transfer ownership of the decedent’s assets. It allows creditors to file claim against an estate. Also, there can be taxes that needed to be collected. - How does the process work?

A simplified list of the steps is: filing of the executed will with the courts, public notification, formal petition, inventory of the estate, payment of debts, and distribution of the remaining assets/final petition. - How long does it take?

There are many factors that can affect the time it takes. The safe bet is a budgeting of at least six months before all is completed. That said, you will want to prepare for it to be longer than that. There can be unsettled claims, proper notification time-frames, issues locating heirs/beneficiaries. We work hard to make sure the real estate portion gets taken care of in the best time frame with the maximum result. - How much does it cost?

The cost of probate varies by state and by area. When all fees are added up (e.g. court costs, appraisal fees, surety bond, and legal and accounting fees), it can easily be between 3-8% of the estate. If there is a contested will, the cost would be higher. - Can I do this without an attorney?

It can be done without legal help; however, it is highly recommend to have legal assistance in this process. You do not want to miss something you may be unaware of. It’s best to have people who handle these processes every day guiding.

To learn more about the probate process and for expert guidance in real estate please contact us.